This is an old piece from Morgan Housel from May 2023. It highlights how optimistic expectations can serve as a “debt” that needs to be “paid off”.

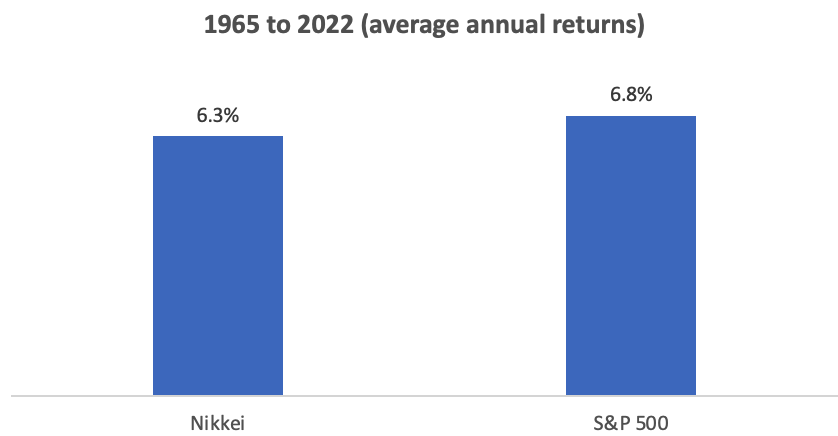

To illustrate this, he gives a fascinating example — the Japanese stock market. From 1965 to 2022, both the Japanese stock market and the S&P500 (a basket of mostly American large companies) had similar returns. As most people know, Japan has had a miserable 3 “lost decades” of growth and stock performance. But Housel presents this fact in an interesting light: it wasn’t that Japan did poorly, it just did all of its growth in a 25 year run between 1965-1990 and then spent the following two decades “paying off” that “expectations debt”.

Housel concludes, as he oftentimes does, with wisdom for all of us: “An asset you don’t deserve can quickly become a liability … reality eventually catches up, and demands repayment in equal proportion to your delusions – plus interest”.

Manage your great expectations.

There’s a stoic saying: “Misfortune weighs most heavily on those who expect nothing but good fortune.”

Expecting nothing but good feels like such a good mindset – you’re optimistic, happy, and winning. But whether you know it or not you’re very likely piling up a hidden debt that must eventually be repaid.

Expectations Debt

Morgan Housel