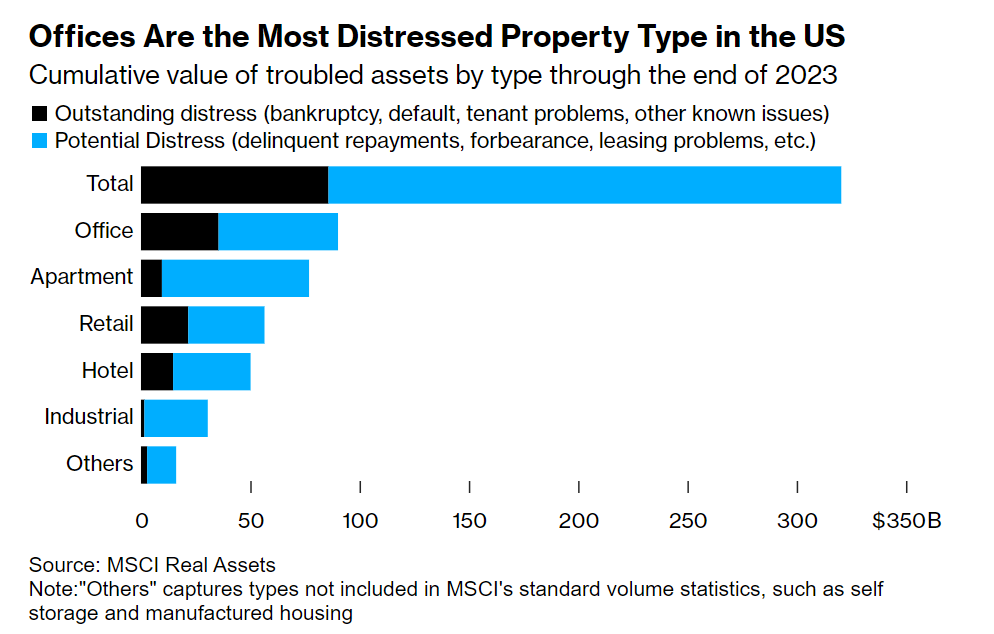

Commercial real estate (and, by extension, community banks) are in a world of hurt as hybrid/remote work, higher interest rates, and property bubbles deflating/popping collide…

Many banks still prefer to work out deals with existing landlords, such as offering loan extensions in return for capital reinvestments toward building upgrades. Still, that approach may not be viable in many cases; big companies from Blackstone to a unit of Pacific Investment Management Co. have walked away from or defaulted on properties they don’t want to pour more money into. In some cases, buildings may be worth even less today than the land they sit on.

“When people hand back keys, that’s not the end of it — the equity is wiped but the debt is also massively impaired,” said Dan Zwirn, CEO of asset manager Arena Investors, which invests in real estate debt. “You’re talking about getting close to land value. In certain cases people are going to start demolishing things.”

The Brutal Reality of Plunging Office Values Is Here

Natalie Wong & Patrick Clark | Bloomberg