I spotted this memo from Oaktree Capital founder Howard Marks and thought it was a sobering and grounded take on what makes a stock market bubble and reasons to be alarmed about the current concentration of market capitalization in the so-called “Magnificent Seven” and how eerily similar this was to the “Nifty Fifty” or the “Dot Com Bubble” eras of irrational exuberance. Whether you agree with him or not, it’s a worthwhile piece of wisdom to remember.

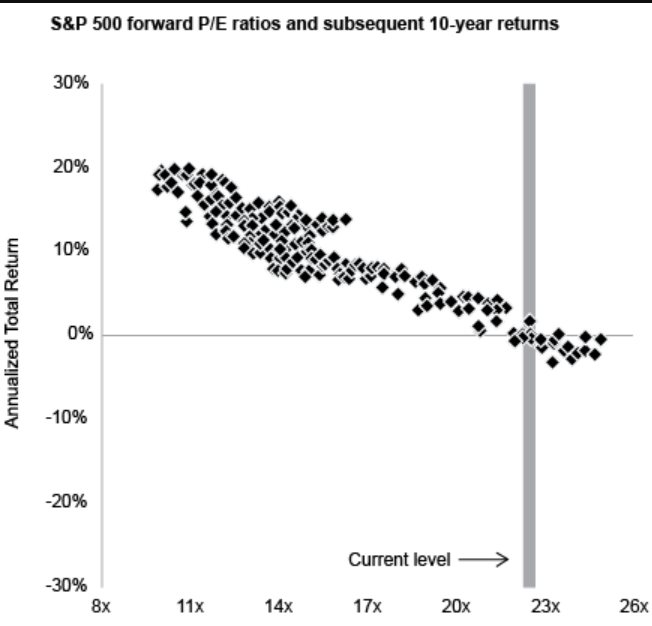

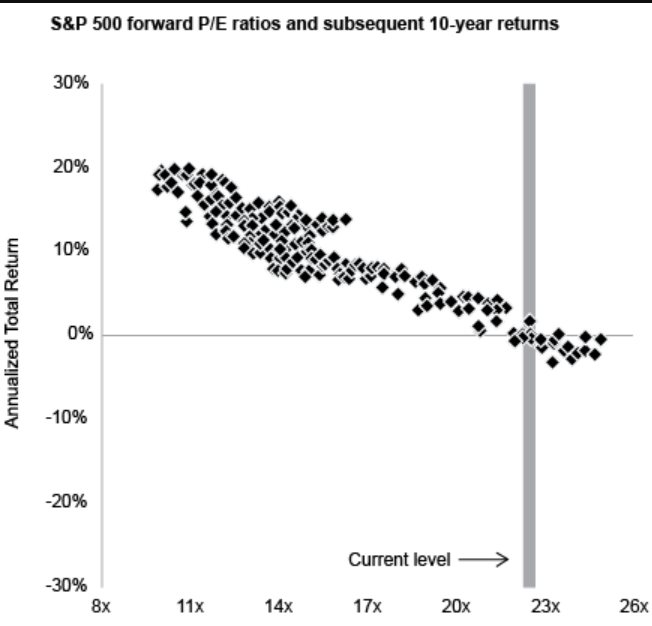

This graph that Marks borrowed from JP Morgan is also quite intriguing (terrifying?)

There’s usually a grain of truth that underlies every mania and bubble. It just gets taken too far. It’s clear that the internet absolutely did change the world – in fact, we can’t imagine a world without it. But the vast majority of internet and e-commerce companies that soared in the late ’90s bubble ended up worthless. When a bubble burst in my early investing days, The Wall Street Journal would run a box on the front page listing stocks that were down by 90%. In the aftermath of the TMT Bubble, they’d lost 99%.

When something is on the pedestal of popularity, the risk of a decline is high. When people assume – and price in – an expectation that things can only get better, the damage done by negative surprises is profound. When something is new, the competitors and disruptive technologies have yet to arrive. The merit may be there, but if it’s overestimated it can be overpriced, only to evaporate when reality sets in. In the real world, trees don’t grow to the sky.

On Bubble Watch

Howard Marks

Leave a Reply