Working on tech strategy consulting case for 18 months ingrains a thing or two in your head about strategy for tech companies, so I thought I’d lay out, in one blog post the major lessons I’ve learned about how strategy in the technology sector works.

To understand that, it’s important to first understand what makes technology special? From that perspective, there are three main things which drive tech strategy:

- Low cost of innovation – Technology companies need to be innovative to be successful, duh. But, the challenge with handling tech strategy is not innovation but that innovation in technology is cheap. Your product can be as easily outdone by a giant with billions of dollars like Google as it can be outdone by a couple of bright guys in a garage who still live with their parents.

- Moore’s Law – When most technologists think of Moore’s Law, they think of its academic consequences (mainly that chip technology doubles every two years). This is true (and has been for over 50 years), but the strategic consequence of Moore’s Law can be summed up in six words: “Tomorrow will be better, faster, cheaper.” Can you think of any other industry which has so quickly and consistently increased quality while lowering cost?

- Ecosystem linkages – No technology company stands alone. They are all inter-related and inter-dependent. Facebook may be a giant in the Web world, but it’s success depends on a wide range of relationships: it depends on browser makers adhering to web standards, on Facebook application developers wanting to use the Facebook platform, on hardware providers selling the right hardware to let Facebook handle the millions of users who want to use it, on CDNs/telecom companies providing the right level of network connectivity, on internet advertising standards, etc. This complex web of relationships is referred to by many in the industry as the ecosystem. A technology company must learn to understand and shape its ecosystem in order to succeed.

Put it all together, what does it all mean? Four things:

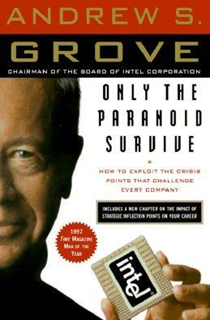

I. Only the paranoid survive

This phrase, popularized by ex-Intel CEO Andy Grove, is very apt for describing the tech industry. The low cost of innovation means that your competition could come from anywhere: well-established companies, medium-sized companies, hot new startups, enterprising university students, or a legion of open source developers. The importance of ecosystem linkages means that your profitability is dependent not only on what’s going on with your competitors, but also about the broader ecosystem. If you’re Microsoft, you don’t only have to think about what competitors like Apple and Linux are doing, you also need to think about the health of the overall PC market, about how to connect your software to new smartphones, and many other ecosystem concerns which affect your profitability. And the power of Moore’s Law means that new products need to be rolled out quickly, as old products rapidly turn into antiques from the advance of technology. The result of all of this is that only the technology companies which are constantly fearful of emerging threats will succeed.

II. To win big, you need to change the rules

The need to be constantly innovative (Moore’s Law and low cost of innovation) and the importance of ecosystem linkages favors large, incumbent companies, because they have the resources/manpower to invest in marketing, support, and R&D and they are the ones with the existing ecosystem relationships. As a result, the only way for a little startup to win big, or for a large company to attack another large company is to change the rules of competition. For Apple, to win in a smartphone market dominated by Nokia and RIM required changing the rules of the “traditional” smartphone competition by:

- Building a new type of user-interface driven by accelerometer and touchscreen unlike anything seen before

- Designing in a smartphone web browser actually comparable to what you’d expect on a PC as opposed to a pale imitation

- Building an application store to help establish a new definition of smartphone – one that runs a wide range of software rather than one that runs only software from the carrier/phone manufacturer

- Bringing the competition back to Apple’s home turf of making complete hardware and software solutions which tie together well, rather than just competing on one or the other

Apple’s iPhone not only provided a tidy profit for Apple, it completely took RIM, which had been betting on taking its enterprise features into the consumer smartphone market, and Nokia, which had been betting on its services strategy, by surprise. Now, Nokia and every other phone manufacturer is desperately trying to compete in a game designed by Apple – no wonder Nokia recently forecasted that it expected its market share to continue to drop.

But it’s not just Apple that does this. Some large companies like Microsoft and Cisco are masters at this game, routinely disrupting new markets with products and services which tie back to their other product offerings – forcing incumbents to compete not only with a new product, but with an entire “platform”. Small up-and-comers can also play this game. MySQL is a great example of a startup which turned the database market on its head by providing access to its software and source code for free (to encourage adoption) in return for a chance to sell services.

III. Be a good ecosystem citizen

Successful tech companies cannot solely focus on their specific markets and product lines. The importance of ecosystem linkages forces tech companies to look outward.

- They must influence industry standards, oftentimes working with their competitors (case in point: look at the corporate membership in the Khronos Group which controls the OpenGL graphics standard), to make sure their products are supported by the broader industry.

- They oftentimes have to give away technology and services for free to encourage the ecosystem to work with them. Even mighty Microsoft, who’s CEO had once called Linux “a cancer”, has had to open source 20,000 lines of operating system code in an attempt to increase the attractiveness of the Microsoft server platform to Linux technology. Is anyone surprised that Google and Nokia have open sourced the software for their Android and Symbian mobile phone operating systems and have gone to great lengths to make it easy for software developers to design software for them?

- They have to work collaboratively with a wide range of partners and providers. Intel and Microsoft work actively with PC manufacturers to help with marketing and product targeting. Mobile phone chip manufacturers invest millions in helping mobile phone makers and mobile software developers build phones with their chip technology. Even “simple” activities like outsourcing manufacturing requires a strong partnership in order to get things done properly.

- The largest of companies (e.g. Cisco, Intel, Qualcomm, etc) takes this whole influence thing a whole step further by creating corporate venture groups to invest in startups, oftentimes for the purpose of influencing the ecosystem in their favor.

The technology company that chooses not to play nice with the rest of the ecosystem will rapidly find itself alone and unprofitable.

IV. Never stop overachieving

There are many ways to screw up in the technology industry. You might not be paranoid enough and watch as a new competitor or Moore’s Law eats away at your profits. You might not present a compelling enough product and watch as your partners and the industry as a whole shuns your product. But the terrifying thing is that this is true regardless of how well you were doing a few months ago — it could just as easily happen to a market leader as a market follower (i.e. Polaroid watching its profits disappear when digital cameras entered the scene).

As a result, it’s important for every technology company to keep their eye on the ball in two key areas, so as to reduce the chance of misstep and increase the chance that you recover when you eventually do:

- Stay lean – I am amazed at how many observers of the technology industry (most often the marketing types) seem to think that things like keeping costs low, setting up a good IT system, and maintaining a nimble yet deliberate decision process are unimportant as long as you have an innovative design or technology. This is very short-sighted especially when you consider how easy it is for a company to take a wrong step. Only the lean and nimble companies will survive the inevitable hard times, and, in good times, it is the lean and nimble companies which can afford to cut prices and offer more services better than their competitors.

- Invest in innovation – At the end of the day, technology is about innovation, and the companies which consistently grow and turn a profit are the ones who invest in that. If your engineers and scientists aren’t getting the resources it needs, no amount of marketing or “business development” will save you from oblivion. And, if your engineers/scientists are cranking out top notch research and development, then even if you make a mistake, there’s a decent chance you’ll be ready to bounce right back.

Obviously, each of these four “conclusions” needs to be fleshed out further with details and concrete analyses before they can be truly called a “strategy”. But, I think they are a very useful framework for understanding how to make a tech company successful (although they don’t give any magic answers), and any exec who doesn’t understand these will eventually learn them the hard way.

Thought this was interesting? Check out some of my other pieces on Tech industry