Summary

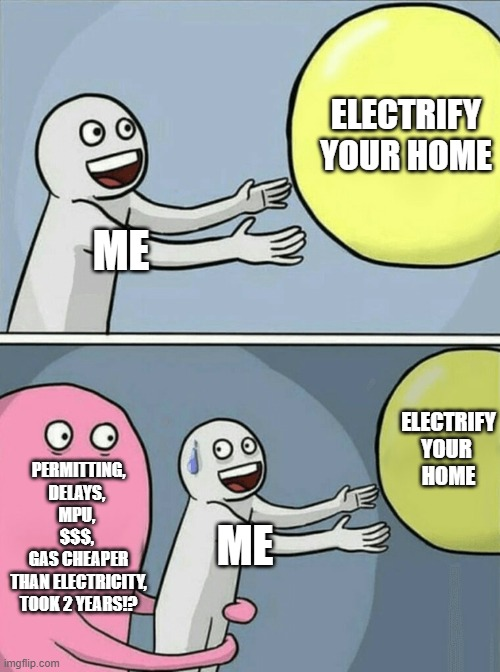

- Electrifying our (Bay Area) home was a complex and drawn-out process, taking almost two years.

- Installing solar panels and storage was particularly challenging, involving numerous hurdles and unexpected setbacks.

- We worked with a large solar installer (Sunrun) and, while the individuals we worked with were highly competent, handoffs within Sunrun and with other entities (like local utility PG&E and the local municipality) caused significant delays.

- While installing the heat pumps, smart electric panel, and EV charger was more straightforward, these projects also featured greater complexity than we expected.

- The project resulted in significant quality of improvements around home automation and comfort. However, bad pricing dynamics between electricity and natural gas meant direct cost savings from electrifying gas loads are, at best, small. While solar is an economic slam-dunk (especially given the rising PG&E rates our home sees), the batteries, in the absence of having backup, have less obvious economic value.

- Our experience underscored the need for the industry to adopt a more holistic approach to electrification and for policymakers to make the process more accessible for all homeowners to achieve the state’s ambitious goals.

Why

The decision to electrify our home was an easy one. From my years of investing in & following climate technologies, I knew that the core technologies were reliable and relatively inexpensive. As parents of young children, my wife and I were also determined to contribute positively to the environment. We also knew there were abundant financial supports from local governments and utilities to help make this all work.

Yet, as we soon discovered, what we expected to be a straightforward path turned into a nearly two-year process!

Even for a highly motivated household which had budgeted significant sums for it all, it was still shocking how long (and much money) it took. It made me skeptical that households across California would be able to do the same to meet California’s climate goals without additional policy changes and financial support.

The Plan

Two years ago, we set out a plan:

- Smart electrical panel — From my prior experience, I knew that many home electrification projects required a main electrical panel upgrade. These were typically costly and left you at the mercy of the utility to actually carry them out (I would find out how true this was later!). Our home had an older main panel rated for 125 A and we suspected we would normally need a main panel upgrade to add on all the electrical loads we were considering.

To try to get around this, we decided to get a smart electrical panel which could:- use software smarts to deal with the times where peak electrical load got high enough to need the entire capacity of the electrical line

- give us the ability to intelligently manage backups and track solar production

In doing our research, Span seemed like the clear winner. They were the most prominent company in the space and had the slickest looking device and app (many of their team had come from Tesla). They also had an EV charger product we were interested in, the Span Drive. - Heat pumps — To electrify is to ditch natural gas. As the bulk of our gas consumption was heating air and water, this involved replacing our gas furnace and gas water heater with heat pumps. In addition to significant energy savings — heat pumps are famous for their >200% efficiency (as they move heat rather than “create” it like gas furnaces do) — heat pumps would also let us add air conditioning (just run the heat pump in reverse!) and improve our air quality (from not combusting natural gas indoors). We found a highly rated Bay Area HVAC installer who specializes in these types of energy efficiency projects (called Building Efficiency) and trusted that they would pick the right heat pumps for us.

- Solar and Batteries — No electrification plan is complete without solar. Our goal was to generate as much clean electricity as possible to power our new electric loads. We also wanted energy storage for backup power during outages (something that, while rare, we seemed to run into every year) and to take advantage of time-of-use rates (by storing solar energy when the price of electricity is low and then using it when the price is high).

We looked at a number of solar installers and ultimately chose Sunrun. A friend of ours worked there at the time and spoke highly of a prepaid lease they offered that was vastly cheaper all-in than every alternative. It offered minimum energy production guarantees, came with a solid warranty, and the “peace of mind” that the installation would be done with one of the largest and most reputable companies in the solar industry. - EV Charger — Finally, with our plan to buy an electric vehicle, installing a home charger at the end of the electrification project was a simple decision. This would allow us to conveniently charge the car at home, and, with solar & storage, hopefully let us “fuel up” more cost effectively. Here, we decided to go with the Span Drive. It’s winning feature was the ability to provide Level 2 charging speeds without a panel upgrade (it does this by ramping up or down charging speeds depending on how much electricity the rest of the house needed). While pricey, the direct integration into our Span smart panel (and its app) and the ability to hit high charging rates without a panel upgrade felt like the smart path forward.

- What We Left Out — There were two appliances we decided to defer “fully going green” on.

The first was our gas stove (with electric oven). While induction stoves have significant advantages, because our current stove is still relatively new, works well, uses relatively little gas, and an upgrade would have required additional electrical work (installing a 240 V outlet), we decided to keep our current stove and consider a replacement at it’s end of life.

The second was our electric resistive dryer. While heat pump based dryers would certainly save us a great deal of electricity, the existing heat pump dryers on the market have much smaller capacities than traditional resistive dryers, which may have necessitated our family of four doing additional loads of drying. As our current dryer was also only a few years old, and already running on electricity, we decided we would also wait to consider heat pump dryer only after it’s end of life.

With what we thought was a well-considered plan, we set out and lined up contractors.

But as Mike Tyson put it, “Everyone has a plan ’till they get punched in the face.”

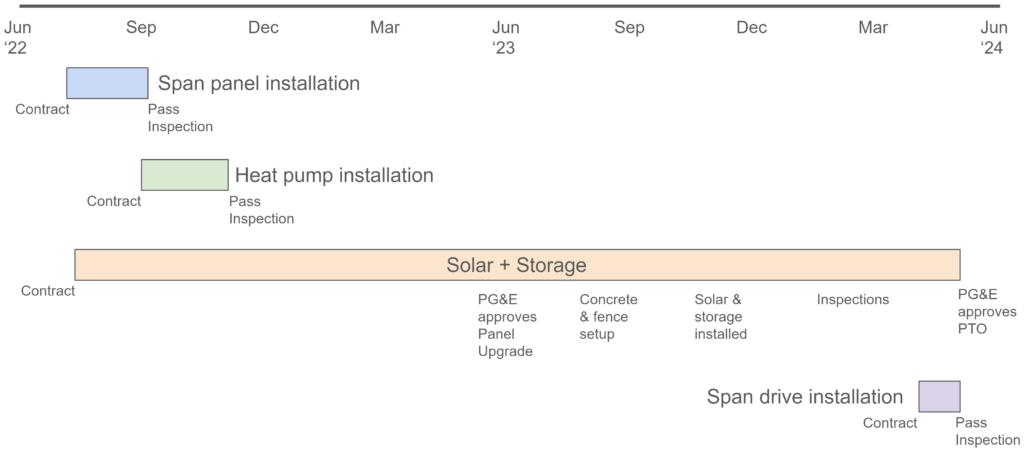

The Actual Timeline

Smart Panel

The smart panel installation was one of the more straightforward parts of our electrification journey. Span connected us with a local electrician who quickly assessed our site, provided an estimate, and completed the installation in a single day. However, getting the permits to pass inspection was a different story.

We failed the first inspection due to a disagreement over the code between the electrician and the city inspector. This issue nearly turned into a billing dispute with the electrician, who wanted us to cover the extra work needed to meet the code (an unexpected cost). Fortunately, after a few adjustments and a second inspection, we passed.

The ability to control and monitor electric flows with the smart panel is incredibly cool. For the first few days, I checked the charts in the apps every few minutes tracking our energy use while running different appliances. It was eye-opening to see just how much power small, common household items like a microwave or an electric kettle could draw!

However, the true value of a smart panel is only achieved when it’s integrated with batteries or significant electric loads that necessitate managing peak demand. Without these, the monitoring and control benefits are more novelties and might not justify the cost.

Note: if you, like us, use Pihole to block tracking ads, you’ll need to disable it for the Span app. The app uses some sort of tracker that Pihole flags by default. It’s an inconvenience, but worth mentioning for anyone considering this path.

Heating

Building Efficiency performed an initial assessment of our heating and cooling needs. We had naively assumed they’d be able to do a simple drop-in replacement for our aging gas furnace and water heater. While the water heater was a straightforward replacement (with a larger tank), the furnace posed more challenges.

Initially, they proposed multiple mini-splits to provide zoned control, as they felt the crawlspace area where the gas furnace resided was too small for a properly sized heat pump. Not liking the aesthetics of mini-splits, we requested a proposal involving two central heat pump systems instead.

Additionally, during the assessment, they found some of our old vents, in particular the ones sending air to our kids’ rooms, were poorly insulated and too small (which explains why their rooms always seemed under-heated in the winter). To fix this, they had to cut a new hole through our garage concrete floor (!!) to run a larger, better-insulated vent from our crawlspace. They also added insulation to the walls of our kids’ rooms to improve our home’s ability to maintain a comfortable temperature (but which required additional furniture movement, drywall work, and a re-paint).

Building Efficiency spec’d an Ecobee thermostat to control the two central heat pumps. As we already had a Nest Learning Thermostat (with Nest temperature sensors covering rooms far from the thermostat), we wanted to keep our temperature control in the Nest app. At the time, we had gotten a free thermostat from Nest after signing with Sunrun. We realized later, what Sunrun gifted us was the cheaper (and, less attractive) Nest Thermostat which doesn’t support Nest temperature sensors (why?), so we had to buy our own Nest Learning Thermostat to complete the setup.

Despite some of these unforeseen complexities, the whole process went relatively smoothly. There were a few months of planning and scheduling, but the actual installation was completed in about a week. It was a very noisy (cutting a hole through concrete is not quiet!) and chaotic week, but, the process was quick, and the city inspection was painless.

Solar & Storage

The installation of solar panels and battery storage was a lengthy ordeal. Sunrun proposed a system with LONGI solar panels, two Tesla Powerwalls, a SolarEdge inverter, and a Tesla gateway. Despite the simplicity of the plan, we encountered several complications right away.

First, a main panel upgrade was required. Although we had installed the Span smart panel to avoid this, Sunrun insisted on the upgrade and offered to cover the cost. Our utility PG&E took over a year (!!) to approve our request, which started a domino of delays.

After PG&E’s approval, Sunrun discovered that local ordinances needed a concrete pad to be poured and safety fence erected around the panel, requiring a subcontractor and yet more coordination.

After the concrete pad was in place and the panel installed, we faced another wait for PG&E to connect the new setup. Ironically, during this wait, I received a request from Sunrun to pour another concrete pad. This was, thankfully, a false alarm and occurred because the concrete pad / safety fence work had not been logged in Sunrun’s tracking system!

The solar and storage installation itself took only a few days, but during commissioning, a technician found that half the panels weren’t connected properly, necessitating yet another visit before Sunrun could request an inspection from the city.

Sadly, we failed our first city inspection. Sunrun’s team had missed a local ordinance that required the Powerwalls to have a minimum distance between them and the sealing off of vents within a certain distance from each Powerwall. This necessitated yet another visit from Sunrun’s crew, and another city inspection (which we thankfully passed).

The final step was obtaining Permission to Operate (PTO) from PG&E. The application for this was delayed due to a clerical error. About four weeks after submission, we finally received approval.

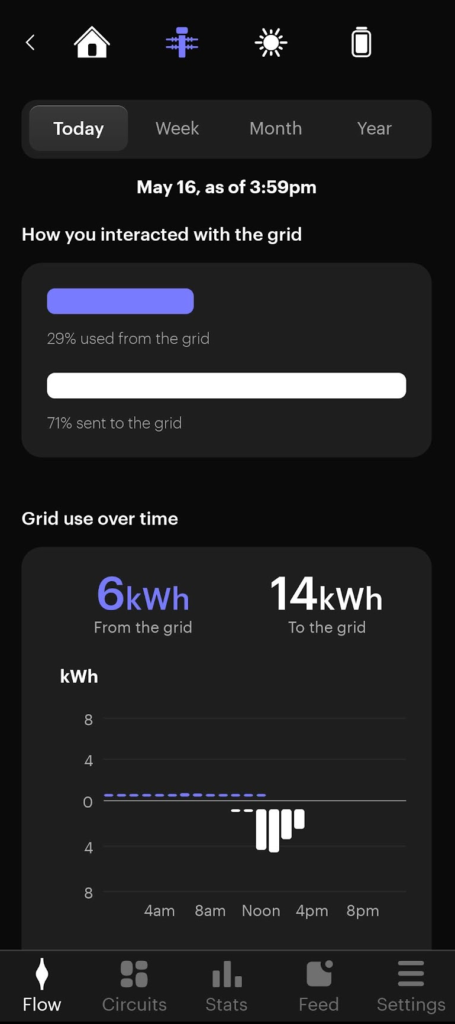

Seeing the flow of solar electricity in my Span app (below) almost brought a tear to my eye. Finally!

EV Charger

When my wife bought a Nissan Ariya in early 2023, it came with a year of free charging with EVgo. We hoped this would allow us enough time to install solar before needing our own EV charger. However, the solar installation took longer than expected (by over a year!), so we had to expedite the installation of a home charger.

Span connected us with the same electrician who installed our smart panel. Within two weeks of our free charging plan expiring, the Span Drive was installed. The process was straightforward, with only two notable complications we had to deal with:

- The 20 ft cable on the Span Drive sounds longer than it is in practice. We adjusted our preferred installation location to ensure it comfortably reached the Ariya’s charging port.

- The Span software initially didn’t recognize the Span Drive after installation. This required escalated support from Span to reset the software, costing the poor electrician who had expected the commissioning step to be a few minute affair to stick around my home for several hours.

Result

So, “was it worth it?” Yes! There are significant environmental (our carbon footprint is meaningfully lower) benefits. But there were also quality of life improvements and financial gains from these investments in what are just fundamentally better appliances.

Quality of Life

Our programmable, internet-connected water heater allows us to adjust settings for vacations, saving energy and money effortlessly. It also lets us program temperature cycles to avoid peak energy pricing, heating water before peak rates hit.

With the new heat pumps, our home now has air conditioning, which is becoming increasingly necessary in the Bay Area’s warmer summers. Improved vents and insulation have also made our home (and, in particular, our kids’ rooms) more comfortable. We’ve also found that the heat from the heat pumps is more even and less drying compared to the old gas furnace, which created noticeable hot spots.

Backup power during outages is another significant benefit. Though we haven’t had to use it since we received permission to operate, we had an accidental trial run early on when a Sunrun technician let our batteries be charged for a few days in the winter. During two subsequent outages in the ensuing months, our system maintained power to our essential appliances, ensuring our kids didn’t even notice the disruptions!

The EV charger has also been a welcome change. While free public charging was initially helpful, reliably finding working and available fast chargers could be time-consuming and stressful. Now, charging at home is convenient and cost-effective, reducing stress and uncertainty.

Financial

There are two financial aspects to consider: the cost savings from replacing gas-powered appliances with electric ones and the savings from solar and storage.

On the first, the answer is not promising.

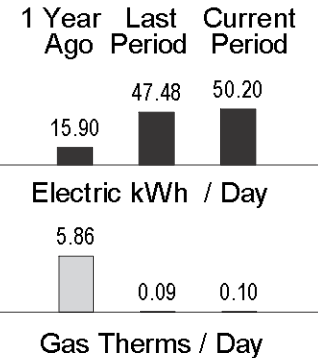

The chart below comes from our PG&E bill for Jan 2023. It shows our energy usage year-over-year. After installing the heat pumps in late October 2022, our natural gas consumption dropped by over 98% (from 5.86 therms/day to 0.10), while our electricity usage more than tripled (from 15.90 kWh/day to 50.20 kWh/day). Applying the conversion of 1 natural gas therm = ~29 kWh of energy shows that our total energy consumption decreased by over 70%, a testament to the much higher efficiency of heat pumps.

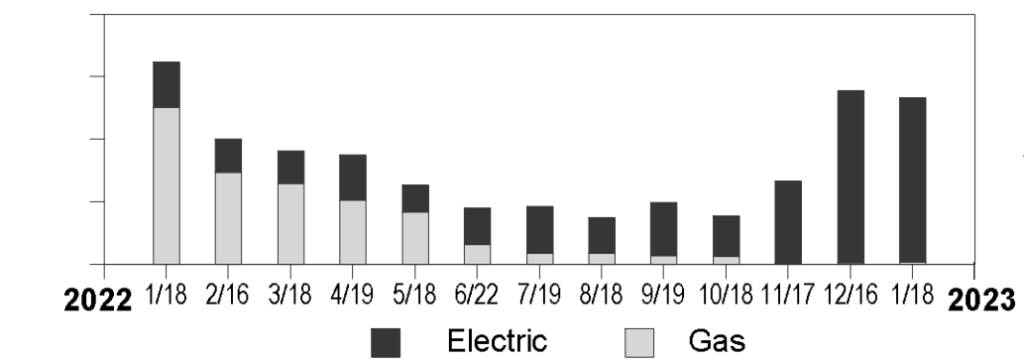

Surprisingly, however, our energy bills remained almost unchanged despite this! The graph below shows our PG&E bills over the 12 months ending in Jan 2023. Despite a 70% reduction in energy consumption, the bill stayed roughly the same. This is due to the significantly lower cost of gas in California compared to the equivalent amount of energy from electricity. It highlights a major policy failing in California: high electricity costs (relative to gas) will deter households from switching to greener options.

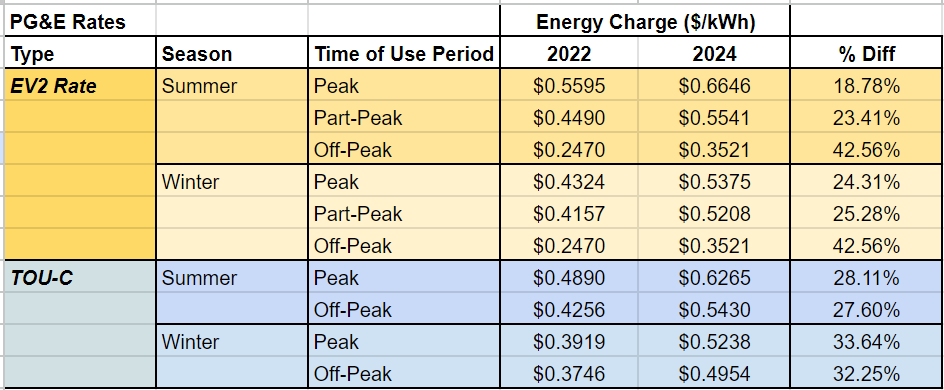

Solar, however, is a clear financial winner. With our prepaid lease, we’d locked in savings compared to 2022 rates (just by dividing the total prepaid lease amount by the expected energy production over the lifetime of the lease), and these savings have only increased as PG&E’s rates have risen (see chart below).

Batteries, on the other hand, are much less clear-cut financially due to their high initial cost and only modest savings from time-shifting electricity use. However, the peace of mind from having backup power during outages is valuable (not to mention the fact that, without a battery, solar panels can’t be used to power your home during an outage), and, with climate change likely to increase both peak/off-peak rate disparities and the frequency of outages, we believe this investment will pay off in the long run.

Taking Advantage of Time of Use Rates

Time of Use (TOU) rates, like PG&E’s electric vehicle time of use rates, offer a smart way to reduce electricity costs for homes with solar panels, energy storage, and smart automation. This approach has fundamentally changed how we manage home energy use. Instead of merely conserving energy by using efficient appliances or turning off devices when not needed, we now view our home as a giant configurable battery. We “save” energy when it’s cheap and use it when it’s expensive.

- Backup Reserve: We’ve set our Tesla Powerwall to maintain a 25% reserve. This ensures we always have a good supply of backup power for essential appliances (roughly 20 hours for our highest priority circuits by the Span app’s latest estimates) during outages

- Summer Strategy: During summer, our Powerwall operates in “Self Power” mode, meaning solar energy powers our home first, then charges the battery, and lastly any excess goes to the grid. This maximizes the use of our “free” solar energy. We also schedule our heat pumps to run during midday when solar production peaks and TOU rates are lower. This way, we “store” cheaper energy in the form of pre-chilled or pre-heated air and water which helps maintain the right temperatures for us later (when the energy is more expensive).

- Winter Strategy: In winter, we will switch the Powerwall to “Time-Based Control.” This setting preferentially charges the battery when electricity is cheap and discharges it when prices are high, maximizing the financial value of our solar energy during the months where solar production is likely to be limited.

This year will be our first full cycle with all systems in place, and we expect to make adjustments as rates and energy usage evolve. For those considering home electrification, hopefully these strategies give hints to what is possible to improve economic value of your setup.

Takeaways

- Two years is too long: The average household might not have started this journey if they knew the extent of time and effort involved. This doesn’t even consider the amount of carbon emissions from running appliances off grid energy due to the delays. Streamlining the process is essential to make electrification more accessible and appealing.

- Align gas and electricity prices with climate goals: The current pricing dynamics make it financially challenging for households to switch from gas appliances to greener options like heat pumps. To achieve California’s ambitious climate goals, it’s crucial to align the cost of electricity more closely with electrification.

- Streamline permitting: Electrification projects are slowed by complex, inconsistent permitting requirements across different jurisdictions. Simplifying and unifying these processes will reduce time and costs for homeowners and their contractors.

- Accelerate utility approvals: The two-year timeframe was largely due to delays from our local utility, PG&E. As utilities lack incentives to expedite these processes, regulators should build in ways to encourage utilities to move faster on home electrification-related approvals and activities, especially as many homes will likely need main panel upgrades to properly electrify.

- Improve financing accessibility: High upfront costs make it difficult for households to adopt electrification, even when there are significant long-term savings. Expanding financing options (like Sunrun’s leases) can encourage more households to invest in these technologies. Policy changes should be implemented so that even smaller installers have the ability to offer attractive financing options to their clients.

- Break down electrification silos: Coordination between HVAC specialists, solar installers, electricians, and smart home companies is sorely missing today. As a knowledgeable early adopter, I managed to integrate these systems on my own, but this shouldn’t be the expectation if we want broad adoption of electrification. The industry (in concert with policymakers) should make it easier for different vendors to coordinate and for the systems to interoperate more easily in order to help homeowners take full advantage of the technology.

This long journey highlighted to me, in a very visceral way, both the rewards and practical challenges of home electrification. While the environmental, financial, and quality-of-life benefits are clear, it’s also clear that we have a ways to go on the policy and practical hurdles before electrification becomes an easy choice for many more households. I only hope policymakers and technologists are paying attention. Our world can’t wait much longer.