One of the core assumptions of modern financial planning and finance is that stocks have better returns over the long-run than bonds.

The reason “seems” obvious: stocks are riskier. There is, after all, a greater chance of going to zero since bond investors come before stock investors in a legal line to get paid out after a company fails. Furthermore, stocks let an investor participate in the upside (if a company grows rapidly) whereas bonds limits your upside to the interest payments.

A fascinating article by Santa Clara University Professor Edward McQuarrie published in late 2023 in Financial Analysts Journal puts that entire foundation into doubt. McQuarrie collects a tremendous amount of data to compute total US stock and bond returns going back to 1792 using newly available historical records and data from periodicals from that timeframe. The result is a lot more data including:

- coverage of bonds and stocks traded outside of New York

- coverage of companies which failed (such as The Second Bank of the United States which, at one point, was ~30% of total US market capitalization and unceremoniously failed after its charter was not renewed)

- includes data on dividends (which were omitted in many prior studies)

- calculates results on a capitalization-weighted basis (as opposed to price-weighted / equal-weighted which is easier to do but less accurately conveys returns investors actually see)

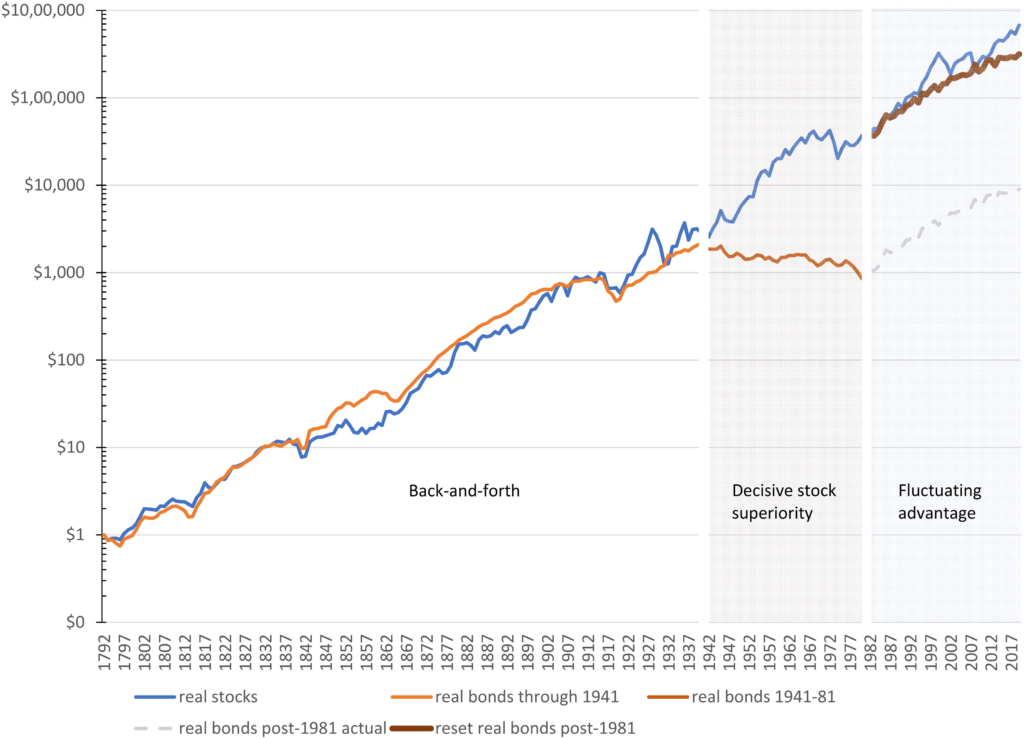

The data is fascinating, as it shows that, contrary to the opinion of most “financial experts” today, it is not true that stocks always beat bonds in the long-run. In fact, much better performance for stocks in the US seems to be mainly a 1940s-1980s phenomena (see Figure 1 from the paper below)

Source: Figure 1, McQuarrie et al

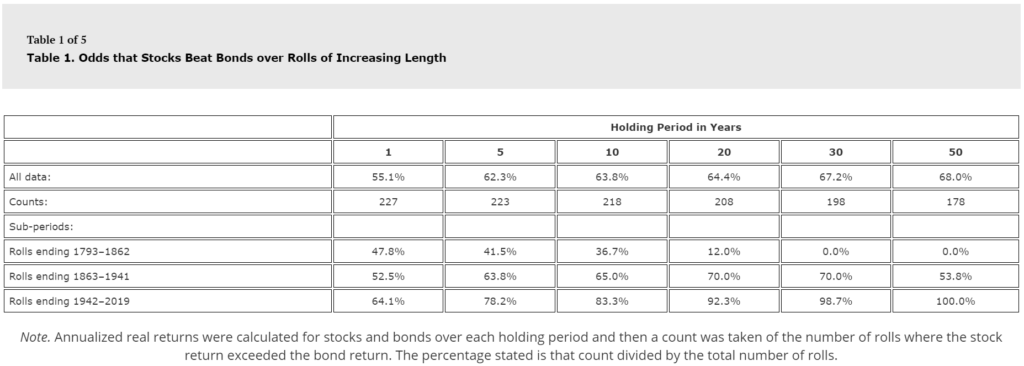

Put another way, if you had looked at stocks vs bonds in 1862, the sensible thing to tell someone was “well, some years stocks do better, some years bonds do better, but over the long haul, it seems bonds do better (see Table 1 from the paper below).

The exact opposite of what you would tell them today / having only looked at the post-War world.

This problem is compounded if you look at non-US stock returns where, even after excluding select stock market performance periods due to war (i.e. Germany and Japan following World War II), focusing even on the last 5 decades shows comparable performance for non-US stocks as non-US government bonds.

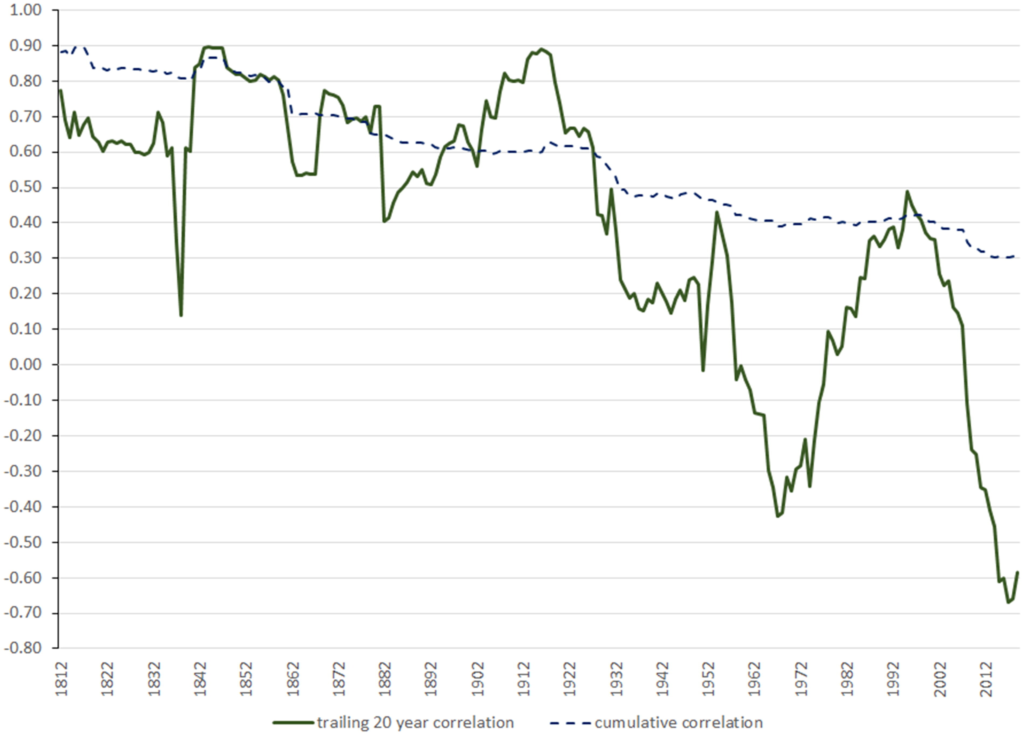

Even assumptions viewed as sacred, like how stocks and bonds can balance each other out because their returns are poorly correlated, shows huge variation over history — with the two assets being highly correlated pre-Great Depression, but much less so (and swinging wildly) afterwards (see Figure 6 below)

Source: Figure 6, McQuarrie et al

Now neither I nor the paper’s author are suggesting you change your fundamental investment strategy as you plan for the long-term (I, for one, intend to continue allocating a significant fraction of my family’s assets to stocks for now).

But, beyond some wild theorizing on why these changes have occurred throughout history, what this has reminded me is that the future can be wildly unknowable. Things can work one way and then suddenly stop. As McQuarrie pointed out recently in a response to a Morningstar commenter, “The rate of death from disease and epidemics stayed at a relatively high and constant level from 1793 to 1920. Then advances in modern medicine fundamentally and permanently altered the trajectory … or so it seemed until COVID-19 hit in February 2020.”

If stocks are risky, investors will demand a premium to invest. But if stocks cease to be risky once held for a long enough period—if stocks are certain to have strong returns after 20 years and certain to outperform bonds—then investors have no reason to expect a premium over these longer periods, given that no shortfall risk had to be assumed. The expanded historical record shows that stocks can perform poorly in absolute terms and underperform bonds, whether the holding period is 20, 30, 50, or 100 years. That documentation of risk resolves the conundrum.

Stocks for the Long Run? Sometimes Yes, Sometimes No

Edward F. McQuarrie | Financial Analysts Journal

Leave a Reply