The rise of Asia as a force to be reckoned with in large scale manufacturing of critical components like batteries, solar panels, pharmaceuticals, chemicals, and semiconductors has left US and European governments seeking to catch up with a bit of a dilemma.

These activities largely moved to Asia because financially-motivated management teams in the West (correctly) recognized that:

- they were low return in a conventional financial sense (require tremendous investment and maintenance)

- most of these had a heavy labor component (and higher wages in the US/European meant US/European firms were at a cost disadvantage)

- these activities tend to benefit from economies of scale and regional industrial ecosystems, so it makes sense for an industry to have fewer and larger suppliers

- much of the value was concentrated in design and customer relationship, activities the Western companies would retain

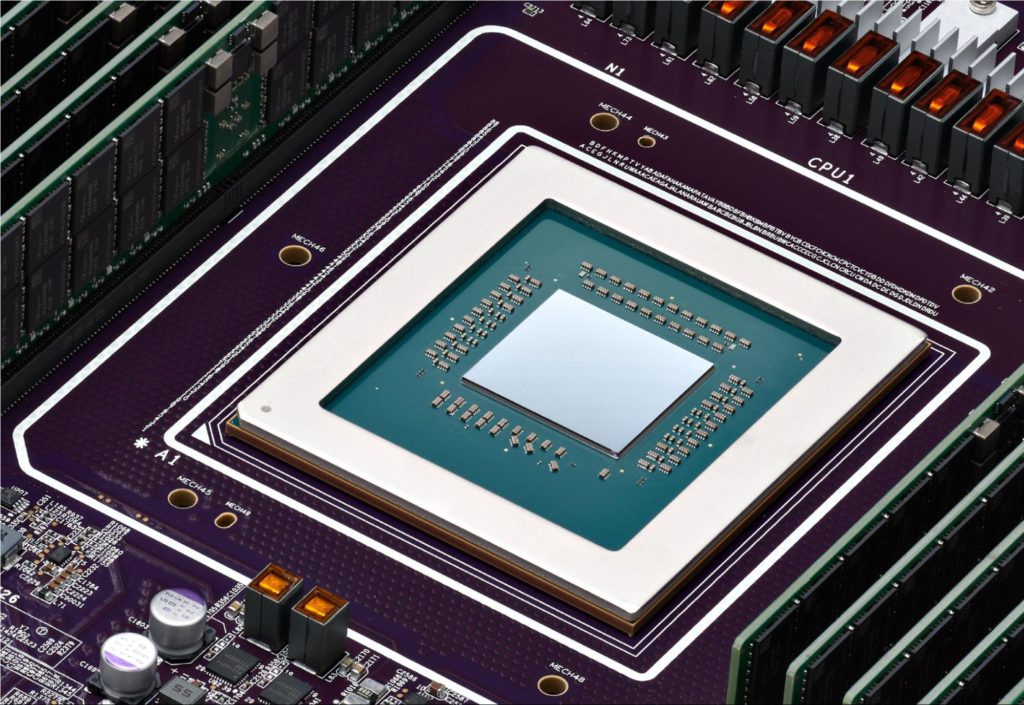

What the companies failed to take into account was the speed at which Asian companies like WuXi, TSMC, Samsung, LG, CATL, Trina, Tongwei, and many others would consolidate (usually with government support), ultimately “graduating” into dominant positions with real market leverage and with the profitability to invest into the higher value activities that were previously the sole domain of Western industry.

Now, scrambling to reposition themselves closer to the forefront in some of these critical industries, these governments have tried to kickstart domestic efforts, only to face the economic realities that led to the outsourcing to begin with.

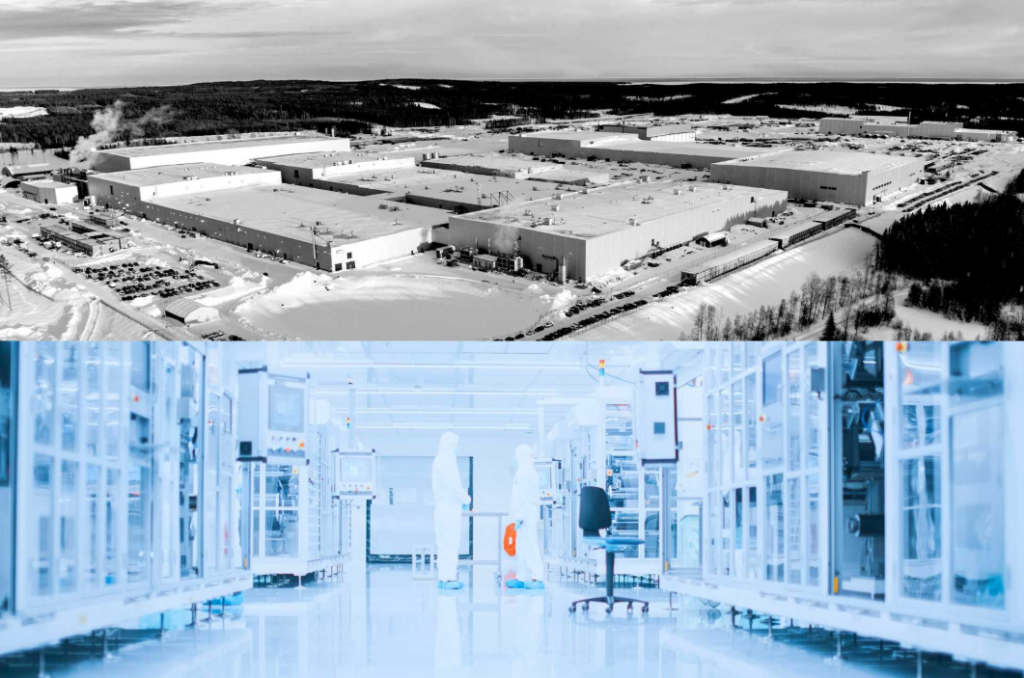

Northvolt, a major European effort to produce advanced batteries in Europe, is one example of this. Despite raising tremendous private capital and securing European government support, the company filed for bankruptcy a few days ago.

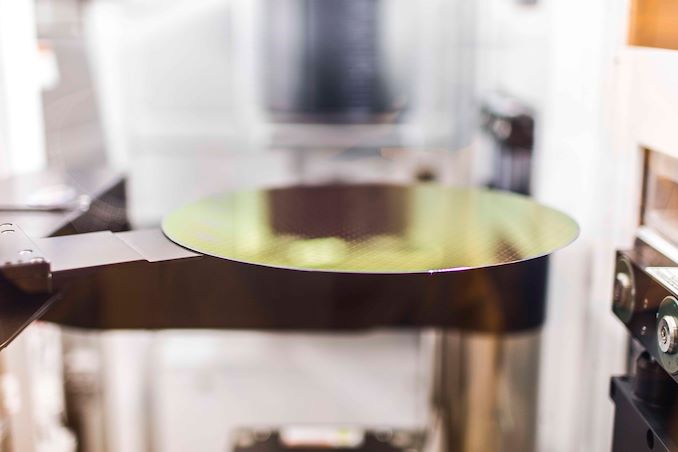

While much hand-wringing is happening in climate-tech circles, I take a different view: this should really not come as a surprise. Battery manufacturing (like semiconductor, solar, pharmaceutical, etc) requires huge amounts of capital and painstaking trial-and-error to perfect operations, just to produce products that are steadily dropping in price over the long-term. It’s fundamentally a difficult and not-very-rewarding endeavor. And it’s for that reason that the West “gave up” on these years ago.

But if US and European industrial policy is to be taken seriously here, the respective governments need to internalize that reality and be committed for the long haul. The idea that what these Asian companies are doing is “easily replicated” is simply not true, and the question is not if but when will the next recipient of government support fall into dire straits.

From the start, Northvolt set out to build something unprecedented. It didn’t just promise to build batteries in Europe, but to create an entire battery ecosystem, from scratch, in a matter of years. It would build the region’s biggest battery factories, develop and source its own materials, and recycle its own batteries. And, with some help from government subsidies, it would do so while matching prices from Asian manufacturers that had dominated global markets.

Northvolt’s ambitious attempt to compress decades of industry development into just eight years culminated last week, with its filing for Chapter 11 bankruptcy protection and the departure of several top executives, including CEO Peter Carlsson. The company’s downfall is a setback for Europe’s battery ambitions — as well as a signal of how challenging it is for the West to challenge Chinese dominance.

What Northvolt’s bankruptcy means for Europe’s battery ambitions

Maeve Allsup | Latitude Media